What is Mutual Funds?

A mutual fund is a type of investment that pools money from many investors to purchase a diversified portfolio Partfalia of securities like stocks, bonds, and other assets. Fund managers, who are professionals, then manage these investments on behalf of the investors, aiming to achieve specific investment objectives.

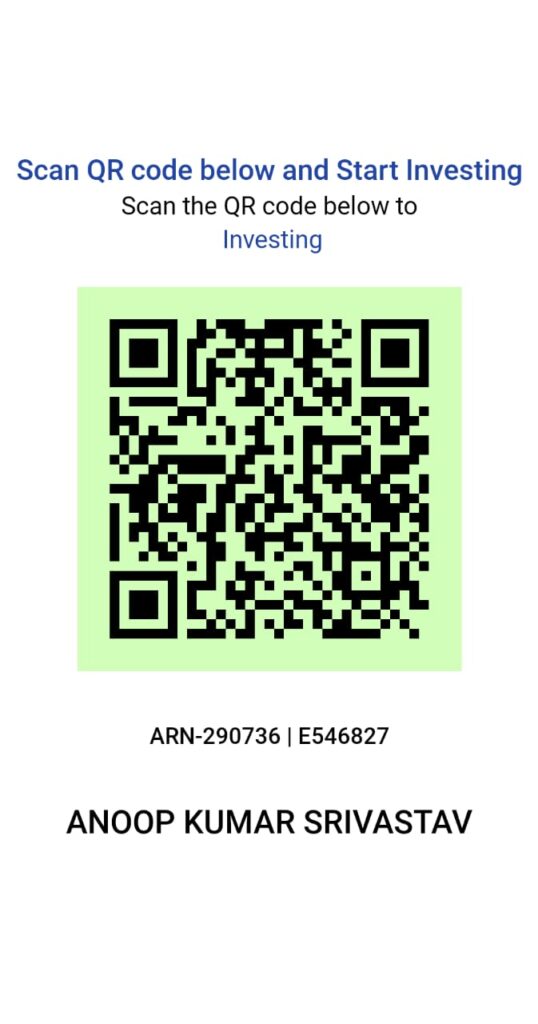

Mutual fund commission, also known as sales load or distribution fee, is a fee charged to investors for purchasing mutual fund units through a distributor or broker. This commission is paid to the distributor for their services in helping investors invest in the mutual fund. The commission structure can vary depending on the type of mutual fund, the distributor’s relationship with the fund company, and the size of the investment.

The three main types of mutual funds, categorized by asset class, are equity funds, debt funds, and hybrid funds. Equity funds invest primarily in stocks, debt funds invest in fixed-income securities, and hybrid funds combine both.

Here’s a more detailed look at each type:

Equity Funds: These funds invest primarily in stocks, aiming for long-term capital appreciation. Examples include large-cap, mid-cap, small-cap, and sector-specific funds.

Debt Funds: Debt funds invest in fixed-income securities like government bonds, corporate bonds, and other debt instruments. These funds aim for stable returns and lower risk compared to equity funds.

Hybrid Funds: Hybrid funds, also known as balanced funds, invest in a mix of equity and debt instruments. This approach aims to balance growth potential with income generation. Examples include balanced hybrid funds, aggressive hybrid funds, and conservative hybrid funds.

What is SIP and how does it work?

Benefits of SIPs:

Disciplined investing: SIPs encourage a regular investment habit, helping investors stay on track with their financial goals.

Rupee-cost averaging: This strategy helps reduce the average cost of investment by buying more units when the price is low and fewer units when the price is high.

Long-term wealth creation: SiPs are a good option for long-term financial goals, such as retirement planning or building a corpus for future needs.

Flexibility: SIPs are designed to be flexible, and most mutual fund schemes allow you to withdraw your money whenever you need it.

Exit Loads: Many mutual funds charge an exit load, which is a fee for withdrawing your investment before a certain period (usually within the first year or to). This charge is typically a percentage of the amount you witharaw.

Lock-in Periods: Some specific types of mutual funds, like Equity Linked Savings Schemes (ELSS), have mandatory lock-in periods (e.g., 3 years for ELSS) where withdrawals are not permitted until the lock-in period is over.

Tax Implications: Withdrawing before the specified periods might also have tax implications, so it’s crucial to understand the tax rules associated with your specific investment.

Partial or Full Withdrawal: You have the option to partially or fully withdraw your SIP amount. A partial withdrawal allows you to take out some of your investment while keeping the rest invested, while a full withdrawal means taking out all your invested money.

| SIP | LUMPSUM | COMMISSION |

|---|---|---|

| Rs. 1,000 | Rs. 1,000 | Rs. 1,00 |

| Rs. 2,000 | Rs. 2,000 | Rs. 2,00 |

| Rs. 5,000 | Rs. 5,000 | Rs. 5,00 |

| Rs. 10,000 | Rs. 10,000 | Rs. 1,000 |

This commission only for one time.

Ex. If you book 3 SIP of Rs. 1,000, 3000 & 5000, and also book 2 Lumpsum of Rs. 5000 & Rs. 10,000 (One time investment) then you get commission.

| SIP | ||

| Rs. 1,000 | Rs. 100 | |

| Rs. 3,000 | Rs. 300 | |

| Rs. 5,000 | Rs. 500 | |

|

|

||

| Lumpsum | ||

| Rs. 5,000 | Rs. 500 | |

| Rs. 10,000 | Rs. 1,000 | |

You get total commission of Rs. 2,400.

For Folio Creation of Customer OFFLINE PAN CARD, AADHAR CARD, CANCELED CHEQUE REQUIRED & OFFLINE SIP FORM with PHOTO & SIGNED.